Omnichannel in Retail: A Practical Guide for Middle East Retail Leaders

A practical guide to building a high-impact omnichannel retail strategy tailored for Middle East retailers and evolving customer journeys.

Feb 12, 2026

Introduction

Retail customers in the Middle East today shop across six or more touchpoints before making a purchase. They browse products on mobile apps, visit flagship stores in mega-malls, and complete transactions online, often within the same day. This behavior has made omnichannel in retail a business priority, not a tech trend.

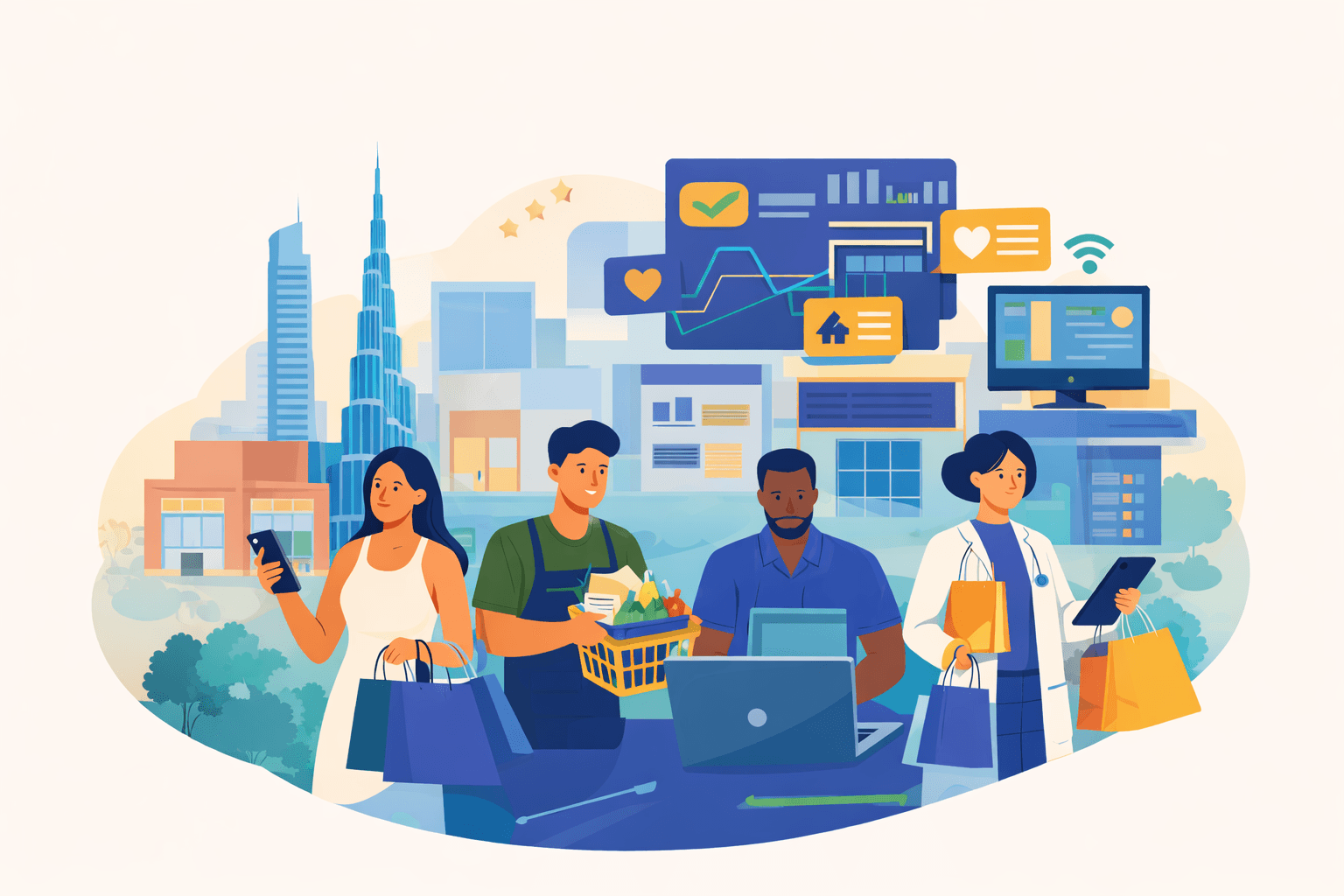

For retail leaders in the region, the pressure is real. Customers expect the same experience whether they interact with your brand on Instagram, at a store in Dubai Mall, or through a delivery app. A fragmented approach leads to lost sales and weakened loyalty.

This guide breaks down what omnichannel in retail in the Middle East looks like in practice and how to build a strategy that delivers measurable results.

What Is Omnichannel in Retail? (And What It Is Not)

Omnichannel in retail means customers can move between channels such as online, mobile, and in-store without friction. Their cart, preferences, and purchase history follow them.

It is not the same as multichannel. Multichannel retailers operate separate storefronts: a website, an app, and a physical shop. These channels often work in silos. Omnichannel retail strategy connects them. A customer can browse online, reserve a product, and pick it up at a store with the transaction logged under one profile.

The difference matters. Retailers with weak cross-channel integration retain only 33% of customers. Those with a strong omnichannel retail strategy retain up to 89%.

How Retail Leaders Should Approach Omnichannel in 2026

In 2026, retailers must move beyond simply operating on multiple channels. The focus now is on building a unified system where physical and digital experiences work together in real time. This is often called "phygital" retail.

Put the customer at the center, not the channel. Break down silos between e-commerce, social, and in-store teams. Build cross-functional groups that own the full customer journey. Focus on three to five high-friction moments like click-and-collect, returns, and onboarding. Measure success through customer lifetime value, not channel-specific revenue.

Treat unified commerce as a baseline. Connect your ERP, POS, warehouse, and e-commerce systems so inventory and customer data sync in real time. Enable endless aisle capabilities so in-store shoppers can order from online inventory and have items shipped home.

Use AI as your operational backbone. AI should power personalization across all touchpoints, predict demand, automate replenishment, and provide store associates with relevant customer data during interactions.

Rethink the role of physical stores. Stores now function as fulfillment hubs, service centers, and experience spaces. Equip associates with devices showing each customer's online history to enable personalized in-store service.

Build a first-party data advantage. With third-party cookies fading, zero-party data becomes critical. Invest in consent management and data governance to turn this into a competitive edge.

Activate social and conversational commerce. TikTok Shop and Instagram now support full in-app shopping. WhatsApp and AI chatbots let customers browse and buy through conversations. Ensure these tools retain context across interactions.

Why Omnichannel in Retail Is Now a Revenue Mandate

The benefits of omnichannel retailing go beyond customer satisfaction. They show up directly in revenue, retention, and operational efficiency.

Higher spend and stronger lifetime value: Customers using multiple channels spend up to 70% more frequently than single-channel shoppers. Omnichannel customers also have a 30% higher lifetime value and show 250% higher purchase frequency. Retailers with strong omnichannel engagement report 9.5% annual revenue growth, compared to just 3.4% for weaker performers.

Online activity fuels offline sales: For non-food retailers, each customer converted online can trigger an equal volume of in-store purchases. Features like click-and-collect bring shoppers into stores, where they often buy additional items. Lower costs through smarter operations: A unified view of inventory reduces stockouts and overstocking by up to 25%. Using stores as fulfillment hubs for ship-from-store or click-and-collect cuts last-mile delivery costs. Physical retail also drives organic traffic at nearly twice the rate of pure-play digital brands, reducing dependence on paid acquisition.

Meets what customers now expect: 79% of shoppers expect consistent interactions across departments. Brands that fail to meet these expectations lose sales to competitors who do.

Omnichannel in Retail in the Middle East: Unique Market Realities

The GCC retail market is projected to grow from 309.6 billion in 2023 to US$ 386.9 billion in 2028. But regional shoppers have behaviors that require a tailored approach to omnichannel in retail in the Middle East.

Mobile-First & App-Centric Shoppers

Smartphone penetration in the UAE exceeds 90%. In 2024, smartphone shipments in the Middle East rose 20% year-on-year. Shoppers expect mobile-optimized experiences, quick checkouts, and app-exclusive offers. If your app experience lags, customers move on.

Mall + Digital Hybrid Culture

Physical retail is not dying in the Middle East. It is evolving. Shoppers still visit malls for the experience but research products online first. A strong omnichannel approach bridges these two worlds.

Cross-Border & Marketplace Growth

UAE consumers frequently shop from international sellers. Platforms like Amazon, Noon, and Namshi dominate online traffic. Retailers competing in this space need integrated fulfillment, regional pricing, and localized payment options.

Loyalty-Driven Retail Culture

Loyalty programs in the GCC are deeply embedded in retail. Apparel Group's Club Apparel program, for example, has crossed 10 million members. Retailers that tie loyalty rewards across all channels, both online and offline, see stronger repeat purchase rates.

The 5 Pillars of a High-Impact Omnichannel Retail Strategy

Pillar 1: Unified Customer Data Platform

All channel data must flow into one customer profile. This includes transaction history, browsing behavior, and engagement across touchpoints. Without a unified data foundation, personalization and attribution fall apart.

Pillar 2: Integrated Loyalty Across Channels

Customers should earn and redeem points whether they shop online, in-store, or via an app. Many top omnichannel retailers now offer app-based loyalty wallets that work seamlessly at checkout counters.

Pillar 3: Inventory & Fulfillment Visibility

Real-time stock visibility prevents lost sales. Features like ship-from-store, click-and-collect, and same-day delivery depend on accurate inventory data across locations.

Pillar 4: Personalization at Scale

AI-driven personalization tailors recommendations, promotions, and content to individual shoppers. In 2024, 76% of Middle East retailers invested in AI solutions to deliver better customer experiences.

Pillar 5: Performance & Attribution Across Channels

You need to measure which channels drive conversions and how they work together. Attribution models help justify omnichannel investment and allocate marketing spend accurately.

Learning from Top Omnichannel Retailers

Several retailers in the region offer useful examples of omnichannel in retail done well.

Al-Futtaim Group launched click-and-collect and same-day delivery for IKEA across the UAE, Saudi Arabia, and Egypt. They also introduced a virtual store experience at IKEA Dubai Mall.

Apparel Group operates over 2,500 stores across 14 countries, with a strong omni-channel setup connecting physical retail with digital platforms.

Jumbo Electronics transitioned from traditional retail to a full omnichannel model, offering seamless integration between its website, app, and store network.

Common Omnichannel Mistakes Retailers in the Middle East Make

Retailers across the GCC are moving fast to adopt omnichannel strategies, driven by initiatives like Saudi Vision 2030 and rising digital expectations. But many still treat online and offline as separate businesses rather than one connected journey. Here are the most common mistakes the retailers make:

Treating channels as separate P&Ls: This creates internal competition instead of collaboration. When e-commerce and retail teams chase different targets, customers feel the disconnect.

Poorly synced inventory and fulfillment: Many retailers cannot support click-and-collect or ship-from-store because their systems do not share stock updates in real time. This leads to order cancellations, delays, and frustrated shoppers.

Fragmented customer data: CRM, ERP, and POS systems often operate in isolation. Store staff have no visibility into a customer's online activity, making personalized service impossible.

Inconsistent pricing and promotions: Showing different prices online versus in-store damages trust. Flash sales on apps that do not reflect in physical locations or marketplaces hurt campaign performance.

Separate loyalty programs for each channel: Customers expect to earn and redeem rewards across all touchpoints. Maintaining siloed programs discourages cross-channel engagement.

Ignoring regional consumer behavior: Over-reliance on cash on delivery without proper verification leads to high return rates. Rushing to adopt trendy tech like AR without a solid omnichannel foundation creates gimmicks, not value.

Disjointed return processes: The inability to offer buy-online-return-in-store creates friction. Poor reverse logistics also delays restocking and eats into margins.

Neglecting staff training: Store teams need to understand how to support click-and-collect, process cross-channel returns, and handle loyalty redemptions confidently.

Retailers looking to unify their customer data and run cross-channel campaigns efficiently often turn to platforms like Loyalytics, which helps brands measure incremental revenue and automate engagement across touchpoints.

FAQs

What is omnichannel in retail?

Omnichannel in retail refers to a unified approach where customers interact with a brand across multiple channels, including online, mobile, and in-store, without disruption. All touchpoints share data, so the experience feels connected.

How is omnichannel different from multichannel retail?

Multichannel means operating separate sales channels. Omnichannel retail strategy integrates those channels so that customer data, inventory, and promotions are synchronized across all of them.

What are the benefits of omnichannel retailing?

The benefits of omnichannel retailing include higher customer retention, increased purchase frequency, and greater lifetime value. Retailers also gain better data visibility and more efficient marketing spend.

Why is omnichannel in retail important in the Middle East?

Regional shoppers are mobile-first, mall-active, and highly engaged with loyalty programs. Omnichannel in retail in the Middle East allows brands to meet these expectations while competing against global marketplaces.

What technologies are required for an omnichannel retail strategy?

A strong omnichannel in retail setup requires a customer data platform, integrated POS and e-commerce systems, real-time inventory management, AI-based personalization tools, and cross-channel analytics.

Related Blogs

Omnichannel Retail in Malaysia: A Strategic Blueprint for Growth-Driven Retailers

Learn how Malaysian retailers can build a scalable omnichannel strategy to increase revenue, retention, and operational efficiency.

Feb 19, 2026

The Ultimate Guide to Customer Loyalty Programs in Malaysia

Learn how customer loyalty programs in Malaysia drive retention, increase sales, and turn first-party data into measurable retail growth.

Feb 19, 2026

Top Retail Companies in UAE: Industry Giants Across Fashion, Grocery, and More

Explore top retail companies in the UAE and how leaders in fashion, grocery, and pharmacy drive growth through data, loyalty, and omnichannel scale.

Feb 13, 2026